Markets Confusing? Ask Edgen Search.

Instant answers, zero BS, and trading decisions your future self will thank you for.

Try Search Now

KAITO: Unleash the Potential of Attention Market

A snapshot on KAITO’s strategy, product, token model, catalysts, and valuation, leaning positive while clear on execution levers. For Kaito guide, click here

TL;DR

- Positioning: Foundational InfoFi rail that monetizes information and attention; sits at AI x Crypto x DeSearch junction.

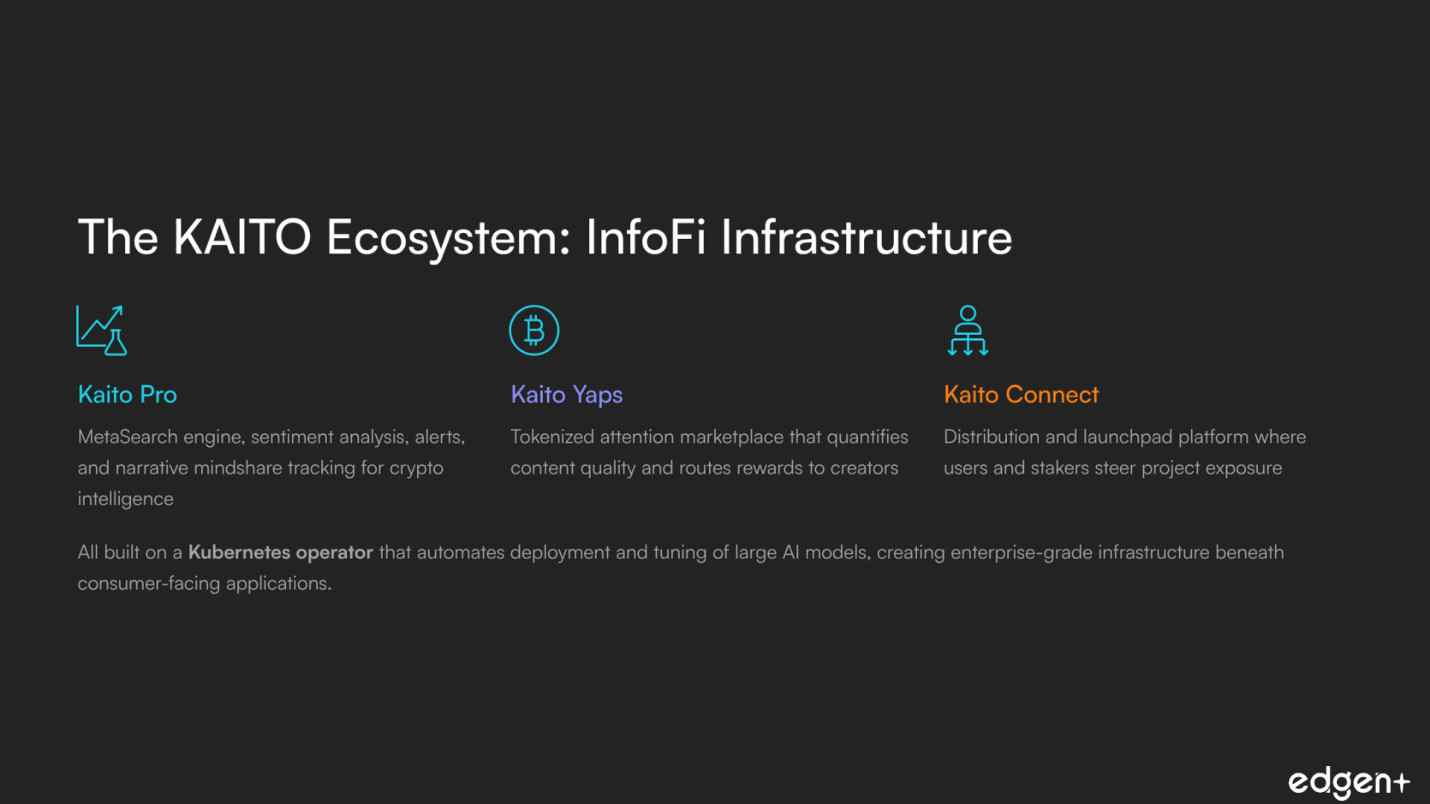

- Product: Pro (intel/search) + Yaps (tokenized attention) + Connect (distribution/launchpad) on a K8s AI operator.

- Proof: Reported $35–40M annualized rev; 200k+ monthly yappers; futures listed; 500+ team/org users onboarded.

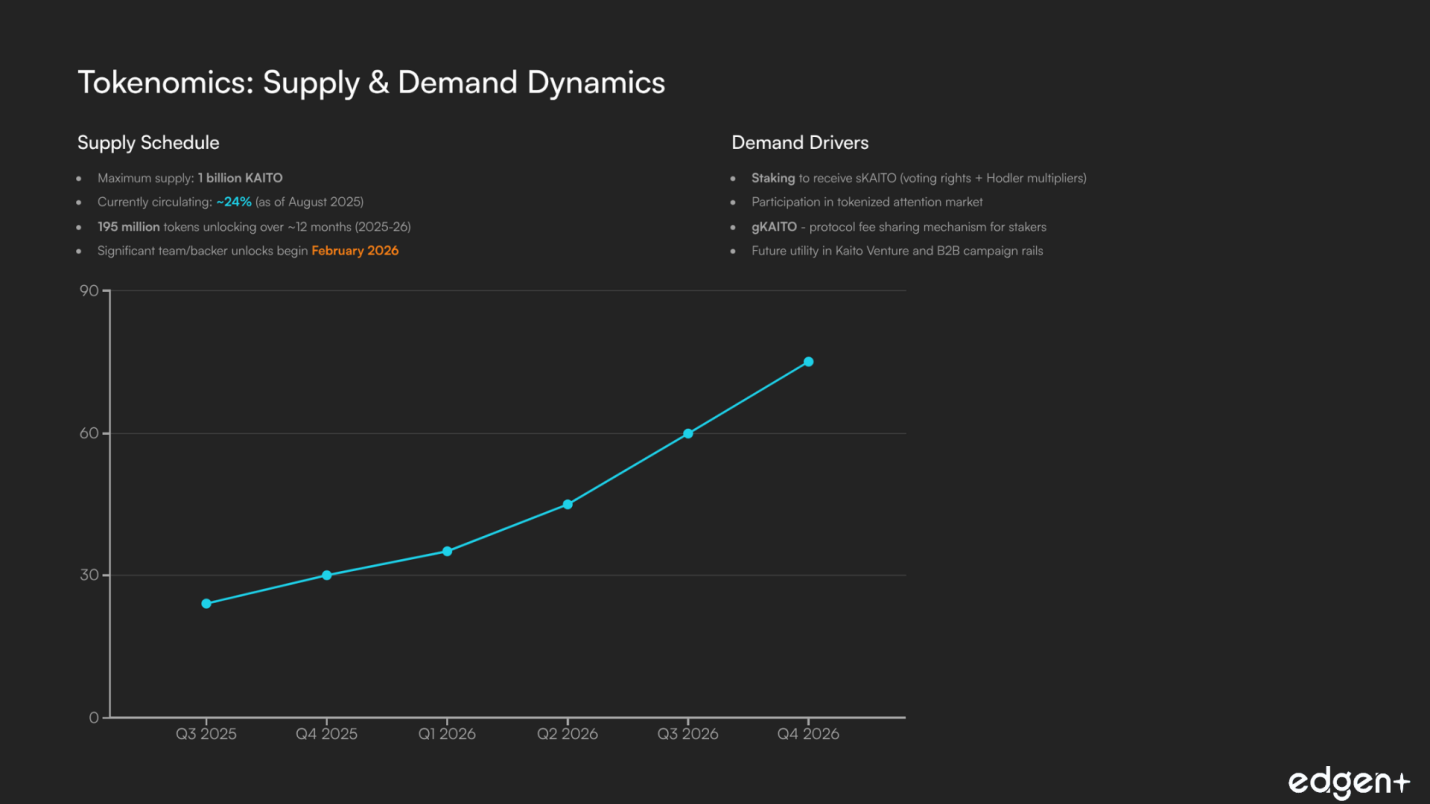

- Token math: ~24% circulating; 195M tokens slated to unlock over ~12 months in 2025–26; much larger team/backer stream starts Feb ’26.

- Fix to watch: gKAITO fee share (staker yield) + quality filters on leaderboards to curb farming.

- Risks: Incentive gaming, centralization (algos + supply), multi-year inflation; competitive pressure (Perplexity/Story/etc.).

What is KAITO

KAITO is an AI-powered information network for crypto. Its backend is a Kubernetes operator that automates deploying/tuning large models; on top, Kaito Pro delivers MetaSearch, sentiment, alerts, and narrative mindshare. Kaito Yaps quantifies content quality and routes tokenized rewards; Kaito Connect turns that attention into a launchpad where users/stakers steer distribution.

The token’s current core utility is staking (sKAITO voting + Hodler multipliers) and participation in the attention market; a gKAITO layer is slated to pipe protocol fees to stakers. The strategy extends to Kaito Venture (investments powered by KAITO’s distribution/AI) and B2B campaign rails, aiming to be the default InfoFi infra others build on.

I. Foundational & Strategic

- Theme fit: AI x Crypto + InfoFi + DeSearch = multiple tailwinds; B2B rails (dYdX/EigenLayer/Story, etc.) deepen moat.

- Tech edge: K8s CRD/controller operator; multi-runtime (vLLM/transformers), RAG support planned; enterprise-grade infra beneath consumer apps.

- Market: AI-crypto and Web3 markets forecast rapid growth; information fragmentation rises with scale > KAITO becomes a needed index/curator.

- Team/backers: Citadel/TradFi + Nansen pedigree; Dragonfly/Sequoia/Jane Street/Superscrypt/Spartan validate and open doors.

Take: The story is credible and timely; infra + B2B distribution creates sticky positioning beyond “yet another analytics tool.”

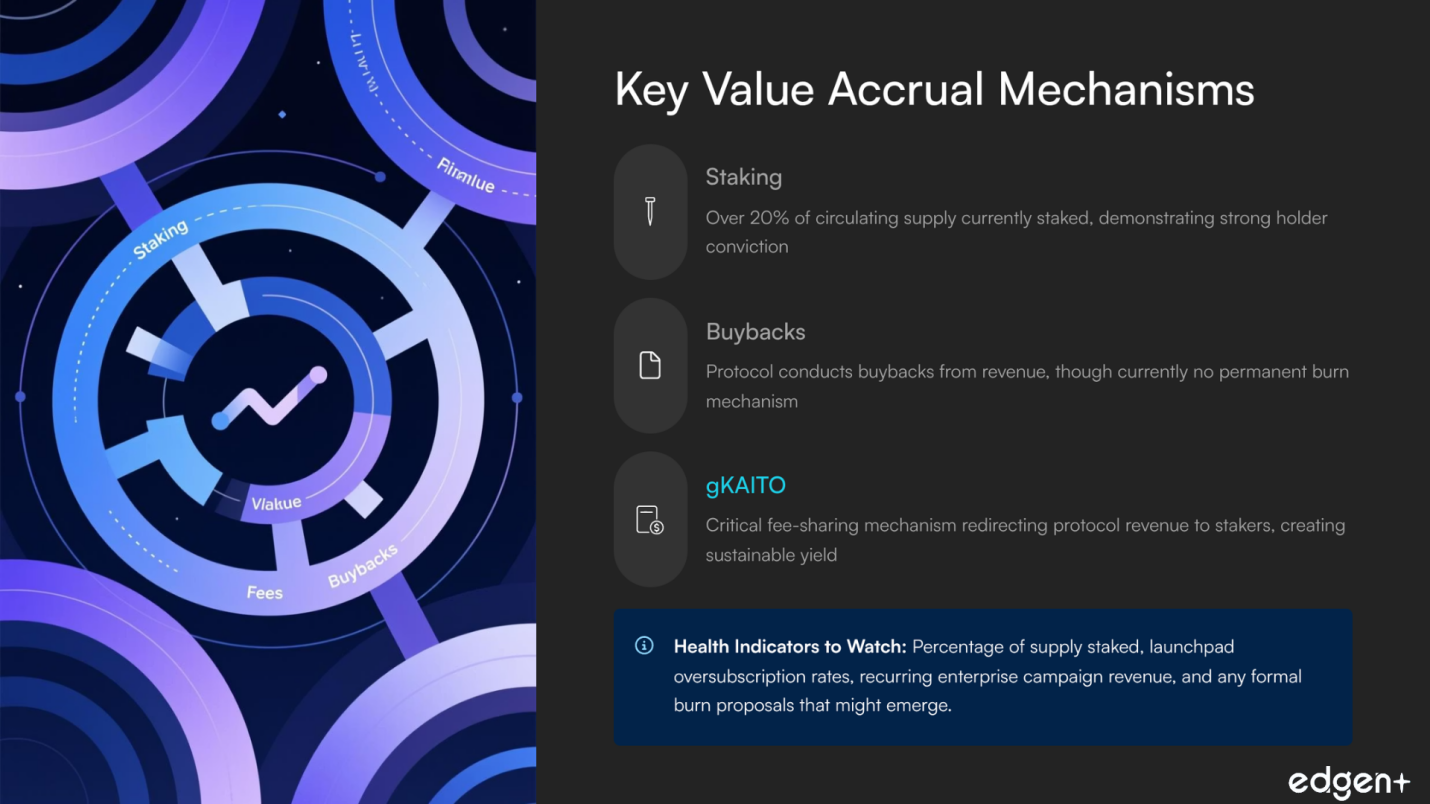

II. Tokenomics & Value Accrual: what to watch

- Supply: Max 1B; ~24% circulating (Aug ’25). Regular monthly unlocks plus large 2026 cliffs (team/backers). Expect persistent emissions.

- Demand: Stake > sKAITO (vote/boost). Usage of Pro doesn’t yet require holding/spending KAITO, watch for tighter linkage.

- Value return: Buybacks exist but not burns. gKAITO (fee share from launchpad/other) is the linchpin, size, cadence, and on-chain proof matter.

- Health gauges: % supply staked (recently >20% of circ), oversubscription on launchpad, recurring enterprise campaigns, and any formal burn proposal.

III. Catalysts & Opportunities

Near term (≤1 month)

- gKAITO go-live (fee share to stakers): biggest de-risking lever for the token.

- Yapper Leaderboard V2 (reputation/anti-spam): improves signal, B2B ROI.

- Post-unlock absorption (Aug/Sept): monitor staking upticks vs. sell flow.

Mid term (1–3 months)

- Kaito Venture cohort: strengthens ecosystem flywheel; new deal flow.

- Competitive pressure (Perplexity/Story): forces differentiation on crypto-native depth and on-chain rails.

- (Stretch) Formal burn mechanism: would materially change the curve.

Long term (6+ months)

- Core team unlocks (Feb ’26 onwards): sustained supply headwind.

- Mobile-native app: expands funnel; retail DAU/retention step-change.

IV. Valuation Scenarios

Scenario | Triggers | FDV / MC Range |

Bull | gKAITO ≥ meaningful share; quality jump; AI narrative hot | $3.0B – $4.0B |

Base | Strong execution but risk-off market; unlock drag | $1.5B – $2.0B |

Bear | Weak execution yet bull tape lifts sector | $600M – $800M |

Disaster | Weak exec + bear market; unlocks swamp demand | $100M – $300M |

Ranges are illustrative; not financial advice.

Final take

KAITO already behaves like a business (real users + revenue) and owns credible infra (K8s operator). The economic bridge to the token is the work left: turn platform fees into staker yield (gKAITO), raise content quality, and keep B2B demand humming to counter a multi-year unlock profile. Nail those, and InfoFi leadership sticks; miss them, and emissions become gravity.

.d8688e9eeef29939.png)

.0c29d07d16f44e1b.png)

.faacf3076e96321f.png)

.8c8bc14ea764ad8b.png)